A Rocky Start for Biosimilar Inflectra? Save

This week, when the FDA approved the biosimilar drug Inflectra as an alternative to infliximab (Remicade), it was only the second biosimilar to be granted approval in the United States, and was the first monoclonal antibody biosimilar.

But it may be years before the product reaches U.S. pharmacies. Remicade's owner asserts that Inflectra infringes on a patent that doesn't expire until September 2018 and vows to "defend our intellectual property rights."

And a number of stakeholders -- not just the makers of Remicade and other branded biologic drugs -- continue to express reservations they see about a lack of clarity around biosimilars.

Clinical Concerns: Substitution and Cost

In response to the announcement of the biosimilar's approval, the president of the American College of Rheumatology, Joan Von Feldt, MD, issued a statement in which she said, "The safe adoption of biosimilars into the U.S. marketplace remains a top priority for the ACR. Biologics are a lifeline for patients living with rheumatic disease, helping many to avoid pain, long-term disability, and life-threatening complications. Unfortunately, many of our patients struggle to afford these complex therapies due to their high cost."

"While America's rheumatologists support the development of new biosimilar therapies, the safety of our patients remains our highest priority. As such, we encourage the FDA to continue to apply distinct names for future biosimilars, and to maximize clarity in the labeling of biosimilars, specifically with respect to their interchangeable status and the origins (reference drug versus biosimilar) of clinical data upon which FDA approval is based," explained Von Feldt, of the University of Pennsylvania in Philadelphia.

Questions about interchangeability and substitution have been a concern, particularly among patient groups such as Patients for Biologics Safety & Access, who have called for "no automatic substitution of biosimilars for biologics. The choice of products should not be determined by a pharmacist, regulator, or insurer but by a prescriber in consultation with his or her patient."

However, "this is not an issue [for Inflectra] because the drug's sponsor neither sought interchangeability designation, nor was it approved as being interchangeable," observed Jonathan Kay, MD, of the University of Massachusetts Medical School in Worcester.

Without that designation, pharmacies cannot substitute the biosimilar in a prescription written for the original drug. But insurers could give the biosimilar agent a preferred position in their formularies and refuse to cover the original product at all.

Rheumatologists seem to be in favor of having the option of biosimilars, but are still concerned about substitutions and costs. "Most rheumatologists welcome the introduction and cost savings but are against forced substitutions -- meaning don't change a drug that is working well," said John Cush, MD, of Baylor Research Institute in Dallas.

When the biosimilar becomes available, "rheumatologists most likely will use it the way they use Remicade now. But for patients newly started on a TNF inhibitor there might be more inclination to use infliximab than the other TNF inhibitors because of the availability of a biosimilar that would be somewhat lower in cost. However, only time will tell," Kay said in an interview.

Douglas White, MD, PhD, of Gundersen Health System in Onalaska, Wis., who chairs the ACR's Committee on Rheumatologic Care, told MedPage Today that "the ACR is hopeful that biosimilars will help reduce the cost of biologics and thus improve patient access to these complex and lifesaving drugs. How much so is uncertain. In fact, if they are not substantially less expensive, then they won't offer any appreciable benefit over their originator drugs," he said.

But "we may have to be careful what we wish for -- if biosimilars are substantially less expensive than their originator drugs, insurance companies may try to force stable patients to switch. We, of course, oppose forced switching," White said.

"The cost saving is an advantage -- but to whose benefit or savings?" asked Cush. "I strongly doubt the savings will be passed on to the patient or the center that does the infusion," he commented.

"We applaud the FDA for their ongoing efforts to make the naming and labeling of these drugs as clear and transparent as possible," White said. "With appropriate roll out and postmarketing surveillance, we think they'll be widely adopted by patients and rheumatologists in the U.S.," he predicted.

However, "immunogenicity (and the potential for adverse reactions related to anti-drug immune responses) is the big question mark with biosimilars. The risk of this type of reaction is not easy to predict in preclinical studies, so we'll all have to be vigilant as these drugs make it to market in order to catch any potential problems as quickly as possible," White explained.

A more muted view was offered by Steven R. Feldman, MD, PhD, of the department of dermatology at Wake Forest University in Winston-Salem, N.C. "It's not like the approval of Cosentyx [secukinumab] or Taltz [ixekizumab]," which are new interleukin-17 inhibitors that are showing promise for conditions such as refractory psoriasis and psoriatic arthritis.

"Drugs like those will help people who haven't been helped before. This [the biosimilar] is just more of the same," he said.

Legal Questions: Patents and Notice

The Biologics Price Competition and Innovation Act (BPCIA), which was part of the Patient Protection and Affordable Care Act signed by President Obama in March 2010, created a process by which the FDA could approve products considered biosimilar.

The process includes a procedure known as the "patent dance," whereby once the application for approval has been submitted to the FDA, a negotiation takes place between the biosimilar sponsor and the reference product sponsor. The biosimilar sponsor provides their application and relevant information about manufacturing, and the reference product sponsor then can respond with any patent or other concerns.

"In the patent dance, there are steps that can dictate to a certain extent when you can go to market," explained Stacie Ropka, PhD, an intellectual property attorney with Axinn Veltrop & Harkrider.

"One of the requirements is that you have to give 180 days notice of commercial marketing," she said.

However, considerable uncertainty exists about this notice of commercial marketing. "Interestingly, the way the BPCIA statute is written, there's nothing per se to stop a biosimilar applicant from launching once they get approval other than the 180-day notice of commercial marketing provision," said Andrew Williams, PhD, of McDonnell Boehnen Hulbert & Berghoff, who specializes in patent litigation in pharmaceuticals and biotechnology.

In the only biosimilars case the Federal Circuit court has decided thus far, Amgen v. Sandoz, it was determined that this notice can only be given once FDA approval is granted, suggesting that it could be 180 days before Celltrion would be able to launch Inflectra, Williams explained to MedPage Today.

However, there's some ambiguity in that decision, which came out last year. In that case, Williams said, Sandoz did not provide Amgen with their biologics license application, and the opinion was written from the perspective of cases where the applicant hasn't handed over their application. "So there's some language that could be read that the 180 day notice is only mandatory in situations where the biologics license application was not handed over," he said.

The Celltrion case is different, in that the company did provide the biologic license application to Janssen, although they did not provide the information about their manufacturing process. "So they're making an argument, based on the Amgen vs Sandoz case, that they don't have to give 180 days notice," Williams said.

But another case underway could influence the outcome. In Amgen v. Apotex, Amgen sued Apotex for patent infringement of pegfilgrastin, a biosimilar to Neulasta. The two companies did go through the patent dance exchange process mandated by BPCIA, but then Apotex told Amgen they weren't going to give 180 days' notice. Amgen then sought an injunction from the court to prevent Apotex from launching, and Apotex took that to the Federal Circuit appeals court.

"On Monday of this week [April 4], the Federal Circuit heard the Amgen v. Apotexcase and that decision will probably come out in the next few months, and should be determinative in the current Janssen vs Celltrion case," Williams said.

And beyond the 180-day stipulation, Janssen and Celltrion continue to disagree about the patent issue. Shortly after the FDA approval was announced, Janssen sent out a statement that read, "Our patents for Remicade remain valid and enforceable until September 2018. A commercial launch of Celltrion's infliximab-dyyb [Inflectra's generic name] in advance of this date would be an infringement of our patents, and we intend to defend our intellectual property rights."

When asked how the company now plans to proceed, Celltrion told MedPage Today, "US6,284,471, which is considered to be the Remicade antibody molecule patent, expires on September 4, 2018. US6,284,471 is currently under re-examination in the U.S. Patent and Trademark Office (USPTO), where the patent holder has appealed the examiner's final rejection of all claims. Although USPTO and court proceedings can be unpredictable, we are confident that the patent will ultimately be found invalid."

Biosimilar Uptake

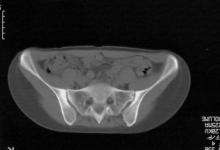

Inflectra has already been approved in numerous countries, including the European Union, Canada, and South Korea. In a study published online in Arthritis & Rheumatology, its uptake in Korea since its approval in November 2012 was examined by Seoyoung C. Kim, MD, ScD, of Brigham and Women's Hospital in Boston, and colleagues.

Kim and colleagues compared medical claims data from the national Health Insurance Review and Assessment database for prescriptions for tumor necrosis factor (TNF) inhibitors during the years 2009 to 2014, finding that before the approval of the biosimilar, there had been 33 new claims for infliximab each month, 50 for adalimumab (Humira), and 44 additional claims for etanercept (Enbrel).

Then, after November 2012, there were nine new claims for either the branded or biosimilar infliximab each month, but a decrease of 21 claims for adalimumab and 52 for etanercept. "Fifteen months since its introduction in Korea, one-fifth of all infliximab claims were for the biosimilar," they reported.

The authors also noted that far more patients with rheumatoid arthritis in the U.S. (about 40%) are given biologics compared with only about 3% in Korea. "Thus, an approved infliximab product could have an even more significant impact on the overall use and costs of biologic therapy in the U.S.," they concluded.

A spokesperson for Pfizer, which will market Inflectra in the U.S., declined to say how the product will be priced.

-- Nancy Walsh, Senior Staff Writer, MedPage Today

Kim and colleagues have received support from the National Institutes of Health, the FDA, Lilly, Pfizer, Amgen and AstraZeneca.

This article is brought to RheumNow by our friends at MedPage Today. It was originally published on April 7, 2016.

If you are a health practitioner, you may Login/Register to comment.

Due to the nature of these comment forums, only health practitioners are allowed to comment at this time.